Any links to online stores should be assumed to be affiliates. The company or PR agency provides all or most review samples. They have no control over my content, and I provide my honest opinion.

Currently, more than $6.6 trillion is traded each and every day on the forex market, with this sum having increased markedly from $5.1 trillion back in 2016.

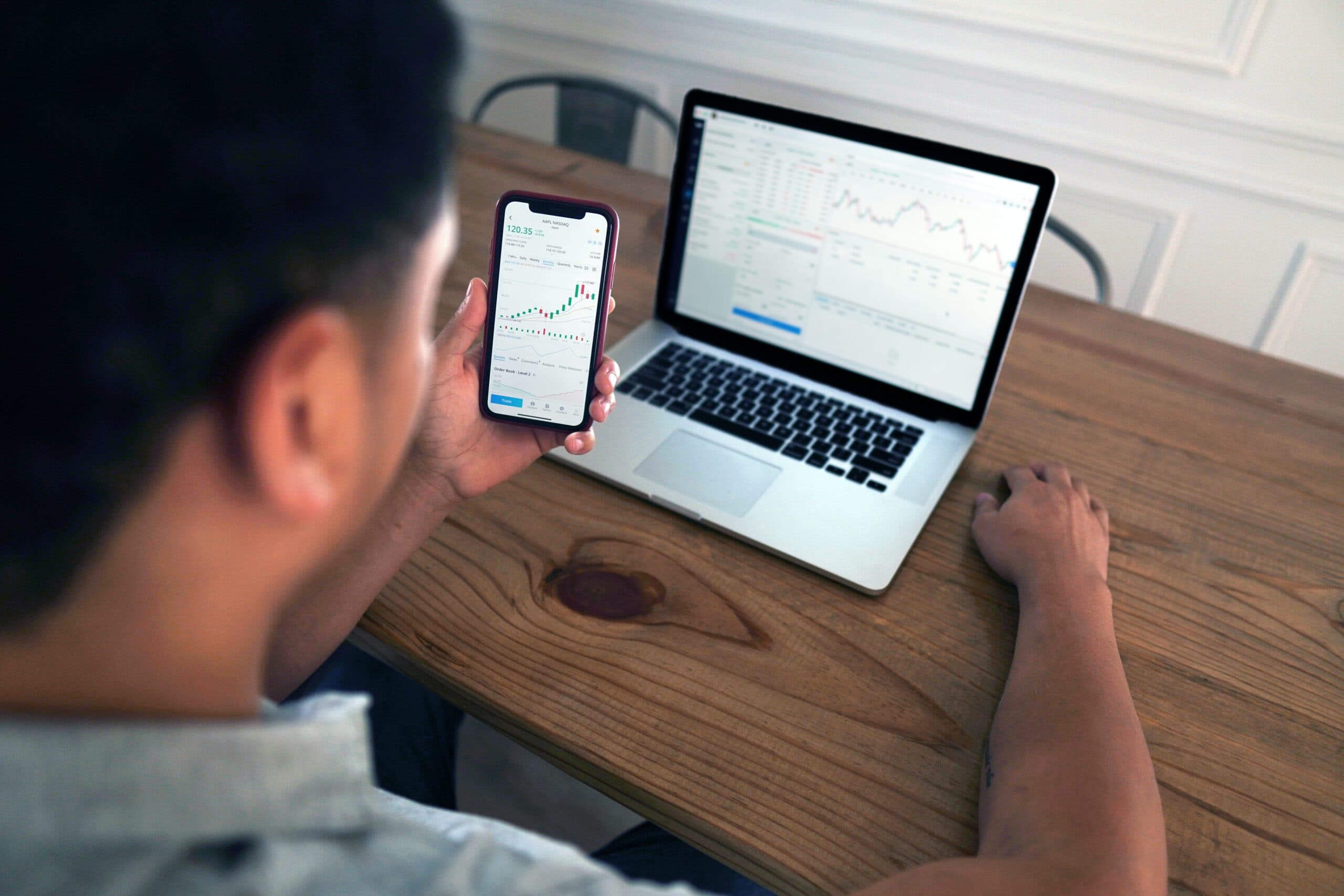

While this growth has been driven in part by the rise of online brokerages that have made the forex market more accessible, it has coincided with increased mobile penetration in the developed world and evolutionary nature of both iOS and Android smartphones.

Interestingly, the rise of mobile trading has also unlocked new opportunities for currency traders to optimise their profitability over time. We’ll explore this in the article below, by asking how certain trading strategies and practices are empowered by smartphone usage.

Embracing Scalping to Drive Short-Term Gains

While many consider day trading to be the embodiment of short-termism in the forex market, it’s the practice of ‘scalping’ that actually takes this honour.

In the wider investment markets, scalping is a broad term that’s used to describe the ‘skimming’ of small profits on a recurring basis, usually by going in and out of positions multiple times each day.

Often, positions will be held for a matter of minutes or even seconds, with a view to accruing small but incremental profits throughout the trading day.

Of course, this is a high-risk strategy that seeks to leverage the forex market’s innate volatility, while it also relies on a set of real-time analytics and requires constant monitoring of the market.

For amateur or part-time traders, this strategy is only really viable if you have a smartphone and are able to maintain real-time access to the forex market regardless of your physical location.

For example, the majority of scalping trades that are placed throughout the trading day are systematic, which means that they’re triggered by a real-time and predetermined set of signals that have been derived from technical analysis.

To identify the most relevant signals, traders are required to engage in comprehensive research and the use of charting tools. Charting comprises a number of different signals, each of which creates a buy or sell decision when they point in the same direction.

Researching the market ahead of implementing a scalping strategy is also easier if you use your smartphone, as you won’t need to be bound to your laptop or desktop computer in order to determine your signals and execute the initial trades.

Ultimately, you’ll have to create rapid entry and exit points in the forex market when scalping, making a number of small trades in order to accrue small but frequent profits over time.

You’ll also need to be decisive and highly disciplined, while ideally retaining real-time market access to help execute your strategy effectively.

Entering the World of Forex Arbitrage Trading

Of course, the forex (or FX) market is filled with a variety of opportunities and trading strategies, the number of which have increased in the digital age.

A particularly interesting example exists in the form of ‘forex arbitrage’ trading, which is similar to scalping in that it has a short-term focus and looks to derive profits within relatively small timeframes.

While scalping targets the market’s innate volatility and naturally occurring price shifts, however, arbitrage trading instead seeks to profit from temporary market inefficiencies.

More specifically, it enables traders to generate a profit in instances where real-time discrepancies occur within free-floating exchange rates. These may result from simple instances of mispricing, or due to the fluctuations that occur between different brokers in the FX market.

For example, forex traders will know that there’s often a minimal, temporary discrepancy that occurs between the exchange rate for the Euro (EUR) and the British pound (GBP). This affects all associated currency pairs (such as the EUR/USD), while creating an opportunity for traders to profit simultaneously from selling EUR/USD and buying EUR/GBP.

Like scalping, such trades look to lock in small but incremental profits from the resulting pricing variations, while you’ll also hold such positions for a vanishingly short period of time (in some cases, just seconds).

Interestingly, arbitrage trading also plays a critical role in regulating the forex market and correcting any temporary price inefficiencies, making it a key but often overlooked strategy in the digital age.

However, there’s no doubt that arbitrage trading can be particularly effective when using a smartphone, thanks to its reliance on real-time analytics and the fact that such trading opportunities often only exist for a very short period of time.

In addition to a contemporary handset, you’ll also need to access sophisticated specialised arbitrage trading software.

A niche example of software for forex trading, this relies on complex algorithms and huge swathes of statistical data that can be used to instantly detect viable arbitrage opportunities and calculate these accurately.

The Bottom Line

These two examples offer a unique insight into the importance of smartphones in contemporary forex trading, especially during periods of peak volatility when the opportunities to profit are immense.

Even on a fundamental level, however, smartphones enable you to constantly stay connected to the forex market and your wider investment portfolio, while also providing you with real-time access to in-depth analysis, macroeconomic news and the economic calendar events that impact markets directly.

Sure, it’s today’s online brokerages that offer such a wealth of information and insight to traders, but being able to access this in real-time wherever you are is highly beneficial for traders.

The key is to ensure that you choose the right device for forex trading, of course, while ensuring that your handset is equipped with the requisite software to suit your underlying trading strategies.

- Always In Touch. …

- Better Informed And Prepared. …

- Special Mobile Bonus. …

- Choosing The Right Devic

I am James, a UK-based tech enthusiast and the Editor and Owner of Mighty Gadget, which I’ve proudly run since 2007. Passionate about all things technology, my expertise spans from computers and networking to mobile, wearables, and smart home devices.

As a fitness fanatic who loves running and cycling, I also have a keen interest in fitness-related technology, and I take every opportunity to cover this niche on my blog. My diverse interests allow me to bring a unique perspective to tech blogging, merging lifestyle, fitness, and the latest tech trends.

In my academic pursuits, I earned a BSc in Information Systems Design from UCLAN, before advancing my learning with a Master’s Degree in Computing. This advanced study also included Cisco CCNA accreditation, further demonstrating my commitment to understanding and staying ahead of the technology curve.

I’m proud to share that Vuelio has consistently ranked Mighty Gadget as one of the top technology blogs in the UK. With my dedication to technology and drive to share my insights, I aim to continue providing my readers with engaging and informative content.