Any links to online stores should be assumed to be affiliates. The company or PR agency provides all or most review samples. They have no control over my content, and I provide my honest opinion.

Curve has become a popular service in recent years, allowing you to aggregates multiple payment cards into one debit card.

While it is not quite the same as the challenger banks such as Monzo, Starling and Revolut, it does offer a premium metal card service that is comparable to some of the other challenger and traditional premium bank account options.

For years, the Nationwide FlexPlus has been one of the most recommended premium bank accounts, thanks to all of its benefits, easily justifying the cost.

Over the years, the Nationwide FlexPlus account has become less appealing thanks to the slashing of interest rates which easily offset much of the cost of the account. It then hiked the overdraft fees eliminating the fee-free buffer.

Of course, Curve is not a bank account itself, but when evaluating whether it is is worth getting the metal card, you need to look at other similar offers on the market.

All the information provided in the post is from my completely unqualified interpretation of the documents I have read. It isn’t extensive, the Curve insurance document is 32 pages long, and I haven’t studied it that much detail. So this won’t be 100% accurate, but hopefully, it will give you an idea of how these premium accounts compare, and you can then research things in detail yourself.

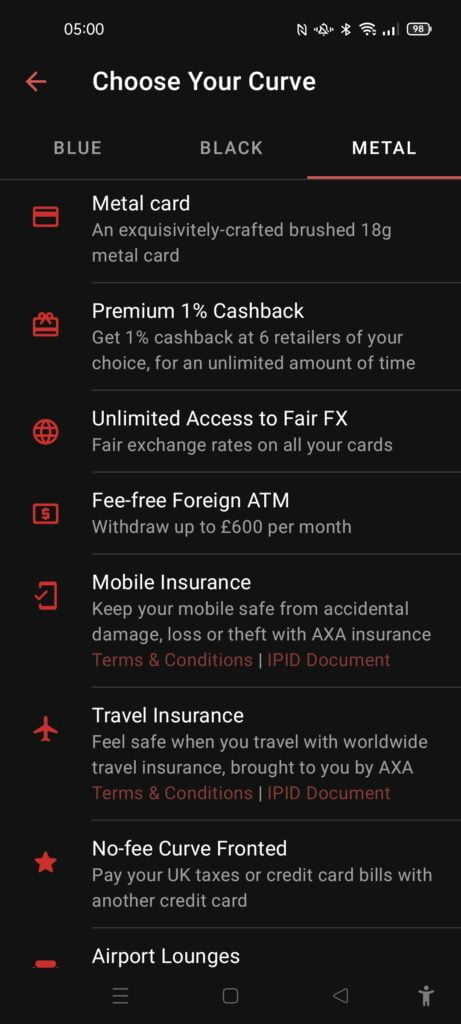

The Curve Metal Plan Overview:

- Premium 18g brushed metal card in 3 unique metal colours

- Supports Mastercard & Visa debit and credit cards, Apple Pay, Google Pay, & Samsung Pay

- 1% cashback at six premium retailers

- Unlimited fee-free spending in 200+ currencies, with access to the interbank rate

- Free foreign ATM withdrawals up to £600 /month

- Go back in time up to £1,000, within 14 days

- Worldwide travel insurance available to residents of the UK (includes lost luggage)

- Electronic device insurance open to residents of the UK, including loss and theft (up to £800)

- Rental car collision damage waiver insurance with coverage provided by AXA Travel Insurance Ltd.

- Access to over 1,000 LoungeKey airport lounges worldwide at up to 60% discount.

Curve Metal vs Nationwide FlexPlus Perks Comparison Table

| Curve Metal | FlexPlus | |

|---|---|---|

| Cost | £14.99pcm £150 per year (equivalent of £12.50 pcm) | £13pcm |

| Travel Insurange | Worldwide travel for your family (partner & Children) £50 excess for most things No cover for pre-existing conditions Trips limited to 90 days Some sports limitations (Skiing and snowboarding are covered) Includes Covid related issues | Worldwide travel for your family £50 excess for most things Cover for winter sports and golf - exclusions apply Doesn't cover pre-existing unless declared and agreed Trips limited to 31 days |

| Phone Insurance | £800 value limit / £50 excess Limited to one claim within a 365 day period. Proof of purchase required Accessories not covered | Mobile insurance for you and your family. Covers loss, theft, damage and faults with your mobile. £1500 value limit Covers accessories 4 claims per FlexPlus account in any 12-month period. £75 damage excess £125 loss escess for Apple £50/£100 for none Apple |

| Breakdown Cover | None but Rental car collision damage waiver insurance | UK and European breakdown cover. For your vehicle and any that you’re travelling in With no excess to pay and unlimited callouts. |

| Foreign Fees | Great FX rates. Fee-free ATM withdrawals. | No Nationwide transaction fees for using your Visa debit card abroad. |

| Cashback | 1% Curve Cash for 6 retailers Various rewards | None |

| Lounge Access | Access to over 1,000 LoungeKey airport lounges worldwide at up to 60% discount. Typically £20 per person | None |

| Card Features | Contactless, Apple Pay, Google Pay, Samsung Pay and Paym | |

| Other Features | Metal Card |

Travel Insurance & Rental Car Collision Damage Waiver

The travel insurance appears to be more or less the same, they both cover immediate family, so your partner and children. You will be a £50 excess on many things.

Curve does provide a rental car collision damage waiver which I guess would be more of a travel perk than anything else. This is a type of protection that limits how much a car hire company will charge for repairs. The rental must be paid for in full with your covered card (unlike your phone insurance).

The main difference I can see is that Curve Metal will cover you for a 90-day trip while Flexplus is limited to 31-days.

Phone Insurance

The phone insurance with Curve Metal is a little confusing as it is bundled in with travel insurance. However, to the best of my knowledge, it also covers theft and damage while at home.

The overall cover isn’t quite as good as Nationwide, but the excess is less depending on the claim and the phone. Nationwide covers everyone in your family, which will be a big bonus for many people.

The £800 value limit is a concern, most flagship phones such as the Samsung Galaxy S21 Ultra cost well over £1000, however, a repair or replacement direct from the OEM is often lower than RRP (it is in the case of Apple).

Breakdown Cover

Curve provides no breakdown cover, whereas Nationwide provides quite a comprehensive cover.

Nationwide will cover any car you are travelling in as long as it is registered in the UK. You get home assistance, roadside and onward travel all included. Then 48-hour hire car benefit.

There is no excess and unlimited call-outs.

Lounge Access and Cashback

Curve has a lounge access perk via Loungekey. With this, you will typically have to pay £20 per person to enter airport longes vs the standard price (£55 to £80 typical). To gain entry, you have to have your Curve Metal Card with you as this is used to pay and get a discount. Anyone in your party can get access to the lounge.

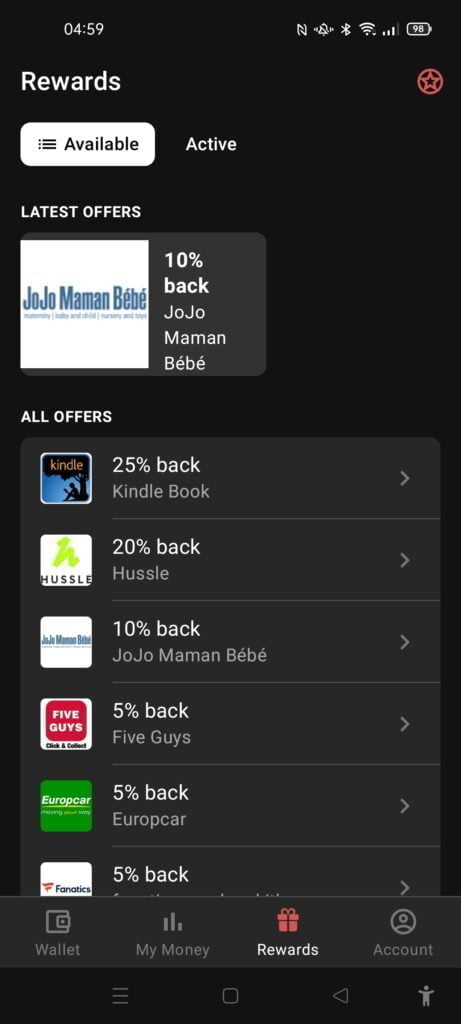

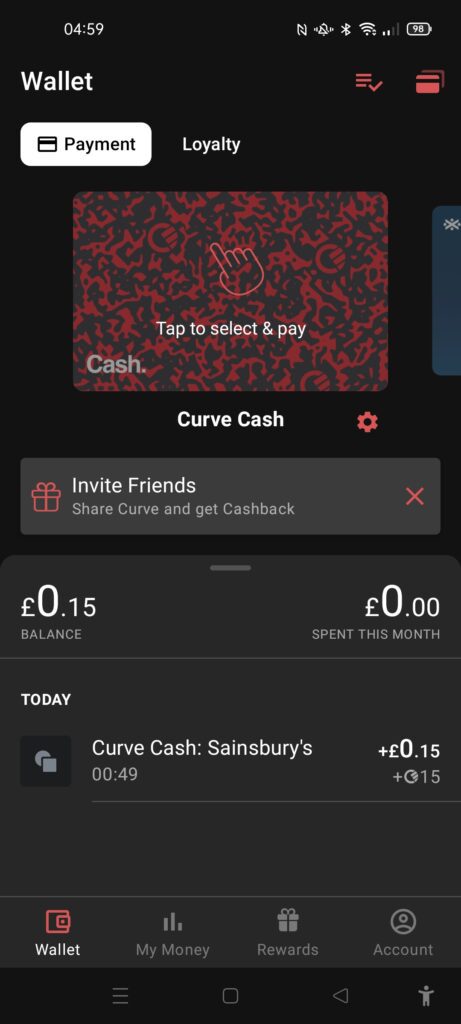

Curve also has various cashback and reward offers. With Curve Cash, you can have 6 selected retailers that will then provide 1% cashback. You also get 1% cashback on most purchases for 30 days.

There are then bonus cashback rewards. For example, there is currently a 25% cashback on an Amazon Kindle book purchase.

I added Sainsbury’s and Aldi to my Curve Cash, I do all my food shopping at these two shops and this can therefore significantly reduce the effective monthly cost.

Overall

Both Curve Metal and Nationwide FlexPlus offer similar overall perks and value for money.

I think Nationwide is a bit better for mobile phone insurance, and the breakdown cover is a big bonus.

However, frequent travellers could benefit a lot from the affordable lounge access of the Curve Metal.

Curve also offers favourable exchange rates while abroad as well as free withdrawals, while Nationwide is just free withdrawals.

Using Curve Cash for food or somewhere else that you spend a significant amount of money can significantly reduce the effective cost of Curve Metal. I probably spend at least £500 between Sainsbury’s, Aldi and Amazon, which would reduce the cost to £10.

I am James, a UK-based tech enthusiast and the Editor and Owner of Mighty Gadget, which I’ve proudly run since 2007. Passionate about all things technology, my expertise spans from computers and networking to mobile, wearables, and smart home devices.

As a fitness fanatic who loves running and cycling, I also have a keen interest in fitness-related technology, and I take every opportunity to cover this niche on my blog. My diverse interests allow me to bring a unique perspective to tech blogging, merging lifestyle, fitness, and the latest tech trends.

In my academic pursuits, I earned a BSc in Information Systems Design from UCLAN, before advancing my learning with a Master’s Degree in Computing. This advanced study also included Cisco CCNA accreditation, further demonstrating my commitment to understanding and staying ahead of the technology curve.

I’m proud to share that Vuelio has consistently ranked Mighty Gadget as one of the top technology blogs in the UK. With my dedication to technology and drive to share my insights, I aim to continue providing my readers with engaging and informative content.