Any links to online stores should be assumed to be affiliates. The company or PR agency provides all or most review samples. They have no control over my content, and I provide my honest opinion.

For most people, the topic of personal spending habits can be a bit of a tricky one. While some can live within their means just fine, there are many people who have a prevailing mentality that there never seems to be enough money in the bank at the end of the month. Some of this can be attributed to spending habits that aren’t really conducive to saving money.

Saving money by evaluating and changing your spending habits can be a change. This is especially the case if you have been in the habit of spending money in a certain way for many years. However, if you have your eyes set on a major purchase down the line, such as a new house or car, then something will need to change sooner rather than later.

The good news is that there are a variety of tech-based solutions that can help you to get a better handle on your spending habits. These solutions go far beyond a simple spreadsheet and can make all the difference in the world when you need to make some changes to your spending habits.

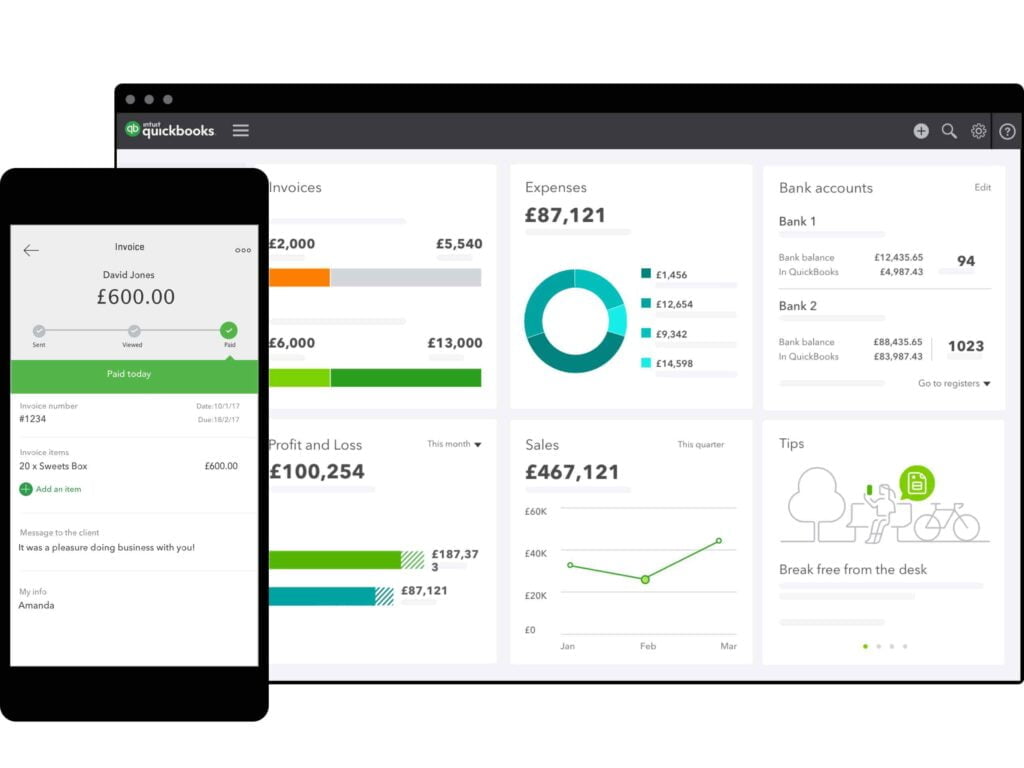

QuickBooks

There are many reasons to use QuickBooks to help you prepare and file your taxes when the time comes, and you can add their Making Tax Digital Software to that list. This is a feature that allows you to digitise your records and VAT returns so that you can have all of your information in one place.

When it comes to adjusting your spending habits, having all of your records in one place and recognising where your spending is going can only help you. This will include all that you have been spending on VAT as well.

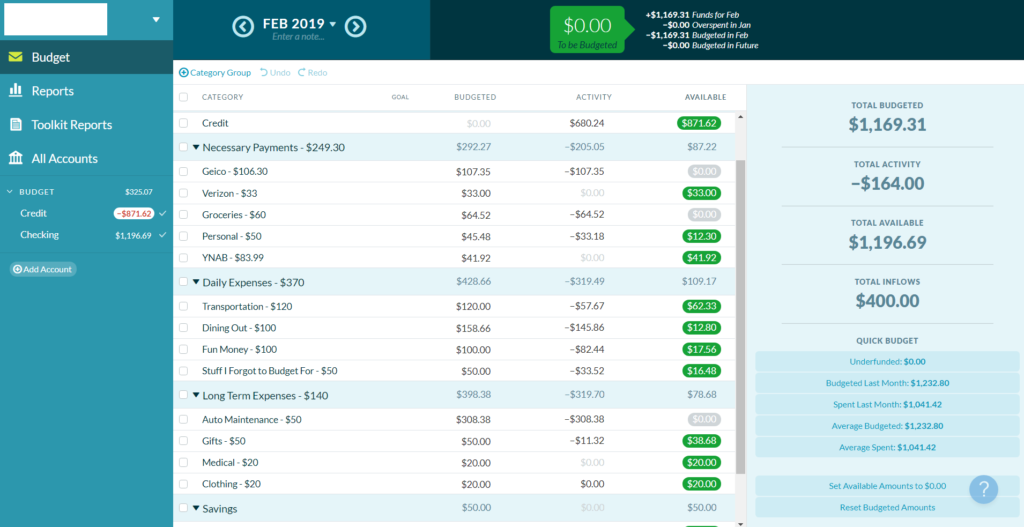

YNAB

You Need a Budget, or YNAB for short, is an incredibly helpful tech-based tool that can help you to get your finances in order and change your spending habits for the better. This is a great tool for those new to creating a personal spending budget and who need a bit of help staying accountable for spending.

This is going to be a particularly helpful solution for those who are looking to get themselves out of debt. The simple, easy-to-use features of YNAB will help you to obtain a clear picture of your spending so that you can figure out how and where change should occur.

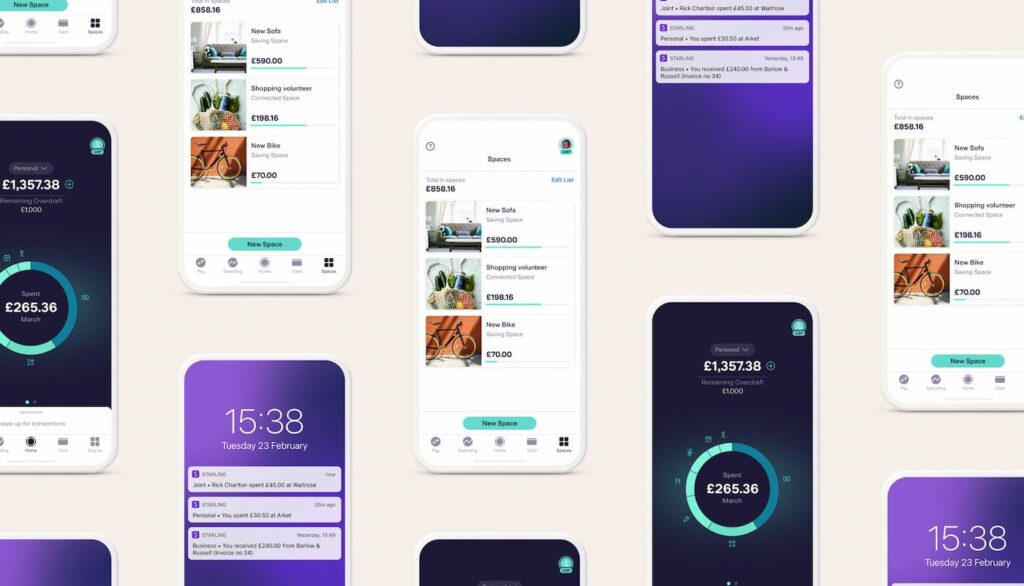

Your Bank’s App

If you are looking for more of a simple approach to changing your spending habits, have a look at your mobile banking app provided by your bank. Most banks these days have features within their apps that allow you to track your spending on a basic level.

You might even be able to obtain a complete breakdown of your spending habits month by month up to this point. Sometimes, coming face to face with exactly what your spending habits have been can provide you with the motivation that you need in order to change for the better.

I am James, a UK-based tech enthusiast and the Editor and Owner of Mighty Gadget, which I’ve proudly run since 2007. Passionate about all things technology, my expertise spans from computers and networking to mobile, wearables, and smart home devices.

As a fitness fanatic who loves running and cycling, I also have a keen interest in fitness-related technology, and I take every opportunity to cover this niche on my blog. My diverse interests allow me to bring a unique perspective to tech blogging, merging lifestyle, fitness, and the latest tech trends.

In my academic pursuits, I earned a BSc in Information Systems Design from UCLAN, before advancing my learning with a Master’s Degree in Computing. This advanced study also included Cisco CCNA accreditation, further demonstrating my commitment to understanding and staying ahead of the technology curve.

I’m proud to share that Vuelio has consistently ranked Mighty Gadget as one of the top technology blogs in the UK. With my dedication to technology and drive to share my insights, I aim to continue providing my readers with engaging and informative content.